Part 1: Where Is My Economic Impact Payment?

The story was originally published in India Currents with support from our 2023 California Health Equity Impact Fund Fellowship.

The radio crackled alive as the lines were opened to listeners. Radio show host, Raman Dhillion fielded queries from perturbed truck drivers and their families with assurance. In the front line on the war against COVID-19, the truck drivers who drive along long lonely roads to keep the essential supplies stocked during the coronavirus outbreak were anxious. What perturbed them today was not just the fear of contracting the virus but the danger of economic penury. Closed businesses and industries along with no freight at docks have seen truck drivers lose money and sleep; and worse, the rates being paid to truckers are below pre coronavirus times.

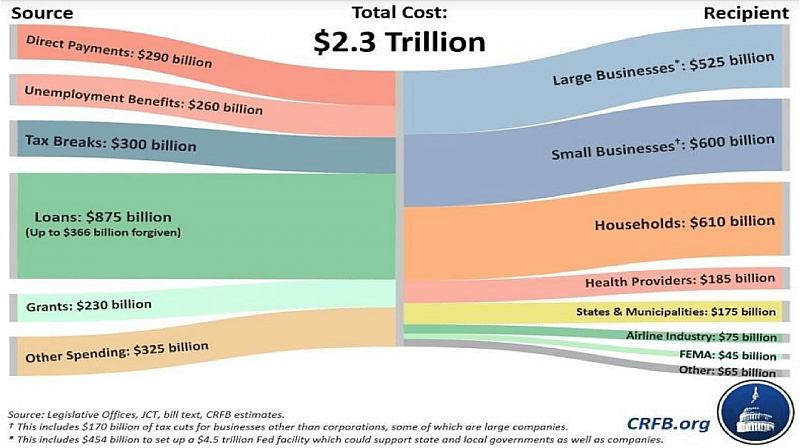

To provide economic life support to small business owners, independent contractors and workers, just like the ones on the other end of Raman Dhillon’s phone line, Congress passed the $2.2 trillion CARES Act (Coronavirus Aid, Relief, and Economic Security Act). The questions being volleyed at the radio host were about how they could benefit from the Act.How can I find out if I am eligible to get funds and how do I go about it?

Anxious questions came fast and furious from people like Bhupinder Singh, an owner-operator or someone who owns the truck he drives; Chandan, who drives a truck for someone else, and Mansi who owns a food business.

Of the more than 3.6 million truck drivers, LA Times estimates that tens of thousands trace their ancestry to India. Raman Dhillon who heads the North American Punjabi Trucking Association (NAPTA) estimates that 30% of California’s trucking industry is run by them.

The importance of keeping the truck drivers in business is clearer now than ever as essential goods need to reach the shelves of health establishments and grocery stores. Truckers need capital or liquidity to keep their wheels turning.

The Where Is My Economic Impact Payment app to be released by Internal Revenue Service’s (IRS) on 17th April promises to address their questions.Additionally the Treasury Department and the Internal Revenue Service’s new web tool, for people who don’t need to file taxes, available April 17th will allow them to register for Economic Impact Payments. (They should look for Non-filers: Enter Payment Info Here on IRS.gov. to go directly to the tool.)

At a press briefing organized by Ethnic Media Services on 8th April, IRS Information Deputy Commissioner, Sunita Lough explained what the workers like Chandan Kumar, independent operators/contractors like Bhupinder Singh and small business owners like Mansi Tiwari could expect.

Chandan Kumar Is An Employee. How Can He Get Funds?

Chandan delivers foodservice products for Saladinos of Fresno to restaurants like Subway, Round Table Pizza, Pizza Factory, Hometown Buffet, Yogurtland etc. As Shelter in Place hit California Chandan’s expenses went up and the number of paid work hours went down. At truck-stops where earlier you could get free coffee if you carried your own cup he now has to pay full price for coffee as they must use disposable cups. Food places are shut or they close early.

Chandan does deliveries really early in the morning wearing disposable vinyl gloves and carrying a sanitizer. Paid for every mile he drives, his income has reduced. Some customers like Subway, though open for business, have plummeting sales; others like Hometown Buffet are closed.

People eligible for unemployment benefits, according to IRS Information Deputy Commissioner, Sunita Lough, include , “Workers who have lost their jobs or have reduced hours of working as shelter-in-place orders are implemented will receive payments. Everyone with a valid Social Security number is eligible to receive the one-time full $1,200 payment and up to $500 for each qualifying child.

Chandan who has two children, has an adjusted gross income that falls within the prescribed salary range of: income up to $75,000 for individuals, $112,500 for heads of household and up to $150,000 for married couples filing joint returns. He is eligible to receive this one time payment of $2,200, but his wife who files a return as a dependent will not get any compensation in her own right.

Filers with income exceeding $99,000 and $198,000 for joint filers with no children are not eligible. Chandan does not fall in that range.

Chandan filed his taxes for 2018, though he is yet to file them for 2019. The IRS will automatically deposit the payment to his bank account provided he has his direct deposit details on file. The IRS says he does not need to take any action. In order to receive an economic impact payment as quickly as possible, direct deposit works faster than a check in the mail.

Chandan’s parents, who receive Social Security, and in the past have not been required to file a tax return, will also receive the money. The Treasury Department and the Internal Revenue Service’s new web tool available April 17th will allow them to register for Economic Impact Payments. (They should look for Non-filers: Enter Payment Info Here on IRS.gov. to go directly to the tool.)

Deputy Commissioner Lough warned of telephone scams and phishing attacks asking for bank accounts and social security numbers. “The IRS does not call and say that,” she said.

Additionally, if Chandan files for unemployment benefits because of his reduced income he will get much more than he normally would have. Under the plan, eligible workers will get an extra $600 per week on top of their state benefit. The maximum weekly state benefit in California is $450. If you are unemployed, partly unemployed or unable to work because your employer closed down, you’re covered under the bill. All eligible workers will get an additional 13 weeks over the state benefits (26 weeks of California) of unemployment through the state’s Employment Development Department.

Part-time workers are eligible for the additional $600 weekly benefit.

If his employer didn’t lay him off but heaven forbid, Chandan has to quit because of a quarantine recommended by a healthcare provider, or if his child’s daycare is closed and he is the primary caregiver, he is covered.

On the other hand Chandan can’t quit his job of his own volition and expect to be paid. If he fears that his job as a truck driver exposes him to the virus and he would like to stop working, he becomes ineligible for unemployment benefits.

Chandan also needs to file his taxes with a social security number. If he files his taxes with an Individual Taxpayer Identification Number (ITIN) he would not get any benefits even if his spouse has a social security number. Everyone in the household would be denied access to the cash assistance.

Bhupinder Singh Is An Independent Contractor. What Can He Get?

Bhupinder Singh, as owner operator of his own truck, is out of luck. Mr. Powell of KP Trucking and Transport feels owner-operator truckers that form a bulk of the industry, are going to be the worst hit by the economic crisis. “They operate on the smallest profit margin. They are so busy day-to-day trying to make ends meet that owner-operators don’t have time to gauge the market, forecast financials and be more creative in generating income. They operate at the lowest rate available just to make sure they have work at all. This group is likely to go out of business. They are already stretching to make payments and are at the mercy of others to keep the business going,” he feels.

“Operating costs are high. The equipment costs are high and they are expensive to repair. It is a hard job. The trucker is on the road 16 hours of the day, and spends the weekend maintaining his truck,” Powell said.

The CARES Act has expanded unemployment benefits to include independent operators/contractors like Bhupinder Singh who weren’t previously covered by unemployment insurance, such as self-employed, temporary workers, part-time workers, freelancers, contract workers, and gig economy workers. The IRS will use the information on their Form SSA-1099 or Form RRB-1099 to make Economic Impact Payments to them of benefits as per their forms.

Singh has a choice to file as a self-employed individual, independent contractor or a small business entity. If he applies for unemployment benefits he will also likely be asked whether he can telework with pay, in which case he would have been ineligible. But as a truck driver he really can’t work from home.

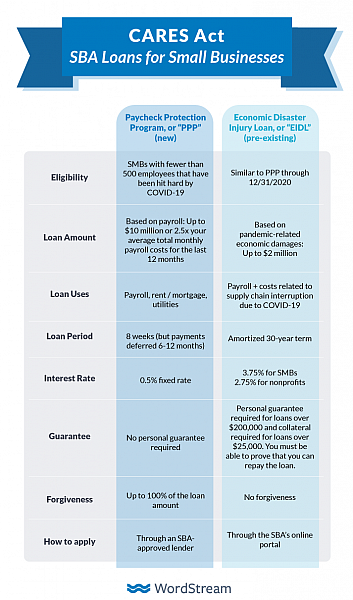

But self-employed folks like Singh, including sole proprietors, and individual contractors working full-time, part-time or other status, are eligible for two types of loans -The Payment Protection Plan (PPP) and Economic Injury Disaster Loan (EDIL). They could apply for the PPP, starting April 10, 2020, through banks insured by FDIC, credit unions or farm credit systems. Here is a list of approved SBA lenders.

Mansi Tiwari Is A Small Business Owner. What Can She Get?

Balvinder Singh Saini and Mansi Tiwari run Punjabi Dhaba, a roadside eatery that serves Indian food, in Bakersfield, California. At the end of their long journey, truckers stop to refuel, shower and eat at truck stops with diesel stations and facilities. Roadside eateries like Punjabi Dhaba serving Indian food are becoming more and more visible along major routes. They are mostly mom-and-pop shops run with skeletal staff. Hot lentil daal soup with whole wheat roti bread awaits the tired trucker in normal times. But these are not normal times and all eateries are shut.

Small business owners like Mansi with bills to pay, are the worst hit. They don’t want to lay off or furlough their employees, especially cooks that are hard to rehire, but they have mortgage, rent and utilities to pay.

To help small business owners retain their employees and stem the tide of unemployment, the CARES Act offers the Payment Protection Plan (PPP), while another option is the Economic Injury Disaster Loan (EDIL), that goes into action when a state of emergency is declared. .

Under the Paycheck Protection Program (PPP), small business owners can apply to banks for eight weeks of cash-flow assistance to maintain payroll during the emergency. No personal guarantee is needed. The loan size would equal 250% of an average employer’s average monthly payroll, with a maximum amount of $10 million and maximum interest rate of 4%. The loan is due in 2 years and carries a 0.50% fixed interest rate. Loan payments will be deferred for 6 months, and the program will be available retroactively from February 15, 2020 enabling employers to rehire any recently furloughed or laid off employees.

There is a possibility that this loan may be forgiven. If the Punjabi Dhaba keeps the same number of employees for the next 8 weeks, even with some reduced pay, the loans may be forgivable as long as 75 % of the loan is spent on payroll. Payroll costs are capped at $100K per employee, annualized. Then Mansi can use the rest 25% of the loan towards payment of mortgage, rent and utilities. It can also be used to pay interest on debt obligations incurred before March 1, 2020.

She will have to apply to have her loan forgiven with documentation verifying how the money was spent. For the portion of the loan that is not forgiven, the rate and term charged would be 1 % fixed for 2 years.

Places like the Punjabi Dhaba and similar small businesses and sole proprietorships can apply for loans through their banks, starting April 3, 2020,from a list of approved SBA lenders.

Unfortunately, with a large number of businesses applying for loans some lending institutions like Wells Fargo are dithering – they are not obligated to and may be unwilling to loan, and the sheer volume of applicants is creating a delay in processing loans. . The SBA is under pressure and responses may take 3 to 4 weeks. So small businesses may have to be patient and settle for just an acknowledgement of receipt of their application for the moment…They can submit the Paycheck Protection Program loan application by June 30, 2020; however interest will continue to accrue over this period.

Mansi can also apply for the Economic Injury Disaster Loan (EDIL) for up to $2M over a 30 year term. EDIL Interest Rates are at 3.75% for small business and 2.75% for non-profits with the first month’s payments deferred a full year from the date of the promissory note. However, since requirements have changed since the announcement of the CARES Act, many small business owners who submitted applications before March 29th are reapplying for loans.

It would be prudent for Mansi to send her application in ASAP as loans are being approved on a first-come first-served basis; she can hope to get funds as long as there is still money in the pot.

What about those that are not eligible? That long list includes non-resident aliens, those with Deferred Action for Childhood Arrival (DACA) status and Temporary Protected Status, H1-B and L-1 work permit holders, truckers too busy to keep on top of paperwork, food workers who are paid in tips that are not recorded income, immigrant workers and all those that oil the wheels of the truckers to ensure a productive ride. For immigrant workers it is going to be extremely difficult to tide over this period.

The drivers make an equivalent of $15-20 an hour and only after 10 years can the trucker even make $25 an hour. Yet the truckers ply the roads delivering essential services against all odds despite the threat of infection. “We cannot have this situation be one that ossifies, that solidifies the inequality and (inability to) access capital. Access to capital is so important,” House Speaker Nancy Pelosi said. The truckers are drowning even as they plod along. They are running out of cash as they wait for the promised loans.